Workshop discusses ways on how to be mindful with your money

The MI CASA and TRIO Student Support Services hosted a workshop on Thursday about how to be mindful with your money. Safe Credit Union Senior Financial Wellness Educator Gina Richardson gave some examples on how finances can be used in a better way throughout our lives.

The Cosumnes River College Multicultural Innovative Community for Academic Success and Achievement & TRIO Student Support Services hosted an event called “How to Have Mindfulness With Your Money” on Thursday.

The event talked about how achieving mindfulness helps you get better at managing your money and to improve your overall financial behaviors, according to the CRC website.

The collaboration MI CASA has with TRIO SSS is that students should be successful later on in their lives, said MI CASA Director Gladis Sanchez.

“One of our main goals with both of our programs is that we want to make sure the students walk out of college with no student debt and that they are setting themselves up for success in the future,” Sanchez said.

TRIO SSS Director Ethny Stewart explained what students should learn about TRIO from the event.

“Just introducing them to professionals at Safe Credit Union and what they provide on an on-going basis,” Stewart said. “We just want students to take away how to think about funding finances, and what to consider broadly.”

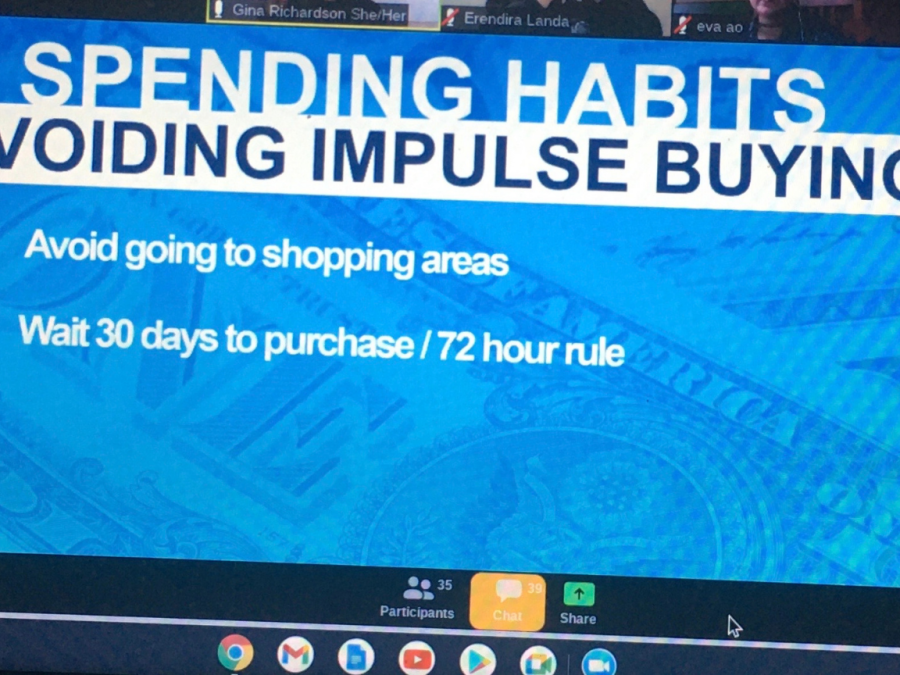

Safe Credit Union Senior Financial Wellness Educator Gina Richardson gave a few examples about how finances can be used in a better way throughout our lives, and there was an interaction with every student during the event.

Richardson spoke about what happens when we don’t have mindfulness when we know we should have.

“If we don’t have mindfulness about what we are doing with our money, we’re not able to have the power that we want,” Richardson said. “Anybody can get money, but how are you spending that money?”

Richardson went into further detail on how we shouldn’t let our money control who we are.

“We don’t want our money telling us what to do,” Richardson said. “You want to be that person that is in that driver’s seat, that’s telling your money what to do.”

Richardson brought up a statistic that said three out of four people stress about money and how we can handle it.

“We create the lives that we have,” Richardson said. “We have the choice of designating where the income goes. We create our bills and we create the responsibilities that we have.”

Richardson said being honest with ourselves about our financial situation comes with not spending money on items we know that we don’t need.

“You want to make sure that you’re not blaming yourself or feeling guilty and it makes you go and spend money that you weren’t intending on spending,” Richardson said.

Twenty-six year-old chemistry major Erendira Landa said she really enjoyed attending the event and she liked how Richardson was explaining each category.

“It had a very good speaker,” Landa said. “She actually wanted us to participate, she made us feel comfortable and there were no wrong answers.”

The next MI CASA event is scheduled for Oct. 9 and it’s called “DSPS Workshop: Demystifying DSPS for Latinx Students.”